Welcome to the neighborhood guide on understanding mortgages for beginners! If you’re pondering the dream of homeownership or considering buying that charming property down the lane, understanding the basics of mortgages is your first step. A mortgage isn’t just a loan for purchasing a house— it’s a gateway to owning a part of your community. Let’s dive into the essentials and help you decode the mortgage mystery, making your path to homeownership as smooth as possible.

A mortgage is essentially your entry ticket into the world of homeownership. Think of it as a special type of loan specifically designed for purchasing real estate. When you decide to buy a home and don’t have the full amount in cash (which is most of us), you take out a mortgage. In exchange for the loan, you agree to pay back the borrowed amount, plus interest, over a fixed period, usually spanning 15 to 30 years. The property you buy serves as collateral, which means if you can’t keep up with your payments, the lender has the right to take possession of the home to recoup their funds.

The process of securing a mortgage might seem daunting, but it’s all about ensuring both you and the lender are on solid ground. To start, you’ll go through an underwriting process where the lender verifies your financial ability to repay the loan and appraises the home to ensure its value meets or exceeds the loan amount. With the green light, you’ll move towards closing, sign the mortgage note, and become a part of the homeowner’s community! Remember, your monthly payment not only includes the loan’s principal and interest but also property taxes, homeowner’s insurance, and possibly private mortgage insurance if your down payment is less than 20%.

- Understanding Mortgages: The Investment of Homeownership Source: moneyunder30.com

Now, onto the types of mortgages — not all are created equal, and choosing the right one could save you a heap of coins. Fixed-rate mortgages and adjustable-rate mortgages (ARMs) are the two primary categories you’ll encounter. Fixed-rate mortgages offer stability with the same interest rate throughout the loan term, making budgeting a breeze. ARMs, on the flip side, adjust the interest rate at predefined periods, which could either save you money or offer a bit of a rollercoaster ride with your monthly payments.

Beyond these, you’ll find conventional mortgages and government-backed options like FHA, VA, and USDA loans, each with their unique benefits and requirements. Conventional loans are your standard fare, not insured or guaranteed by the federal government. FHA loans are great for first-timers with lower credit scores or savings, offering lenient down payments and credit requirements. VA and USDA loans can offer incredible benefits like zero down payment options for qualified individuals and properties. It’s all about finding the shoe that fits your financial situation and homeownership goals.

- Exploring Options: Types of Mortgages Available Source: rocketmortgage.com

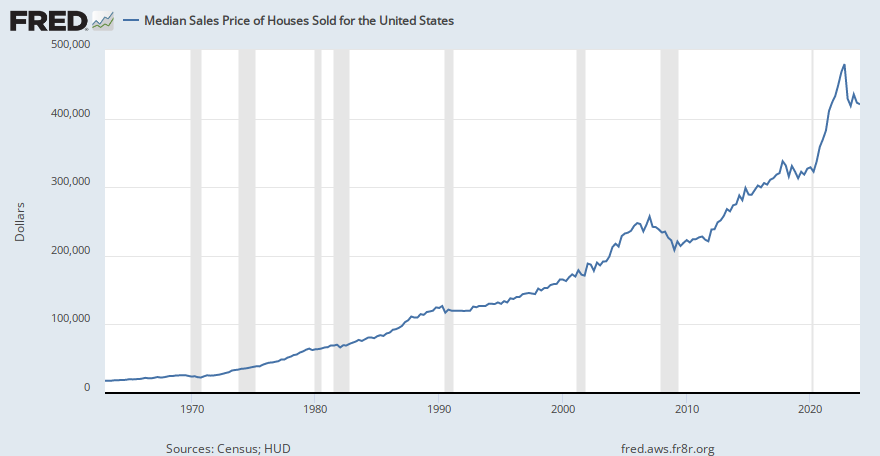

Understanding how mortgage rates, terms, and payments work is like decoding a secret map to treasure— the treasure being paying less over the life of your loan. Interest rates significantly impact your monthly payments and overall loan cost. They can fluctuate based on the economy, your credit score, down payment, and the loan type and term you choose. The difference a percentage point makes in interest rates can be startling, affecting the affordability of your dream home.

Let’s not forget the additional costs rolled into your mortgage payment, which include property taxes, homeowner’s insurance, and potentially mortgage insurance. These aren’t just add-ons but crucial components that protect you and the lender throughout the life of your mortgage. They ensure your home stays yours, come rain or shine (literally and figuratively).

- Market Realities: How Home Prices Influence Mortgages Source: moneyunder30.com

Before you can call a place yours, there’s the matter of preparing and applying for a mortgage. It begins with understanding the difference between pre-approval and pre-qualification. Pre-approval is your golden ticket in home shopping, offering a more concrete stance on what you can afford, whereas pre-qualification is more of a ballpark estimate of your financial standing.

Your credit score, budgeting for a down payment, and gathering essential financial documents are vital steps in this journey. And remember, the down payment is your stake in the game— the higher it is, the less you’ll borrow, and vice versa. But fear not, options abound for those unable to save the traditional 20%, with many loans requiring significantly less upfront.

- Conventional Wisdom: The Role of Fannie Mae and Freddie Mac in Mortgages Source: rocketmortgage.com

Embracing the mortgage journey can be empowering with the right knowledge and tools at your disposal. From deciphering mortgage types and terms to navigating interest rates and payments, consider this your foundational guide to joining the homeownership ranks. Remember, every mortgage payment is a step toward building your personal and community legacy. So, welcome to the neighborhood, future homeowner— your dream home awaits!